Income Tax Brackets - 2011 Income Tax Brackets - Business Insider - The 2021 federal income tax brackets and tax rates are the same as 2020.

Income Tax Brackets - 2011 Income Tax Brackets - Business Insider - The 2021 federal income tax brackets and tax rates are the same as 2020.. The irs released the federal marginal tax rates and income brackets for 2021 on monday. Tax brackets result in a progressive tax system, in which taxation progressively increases as an individual's income grows. Once you have entered the necessary information into our federal tax brackets calculator you will be provided with. There are seven tax brackets for most ordinary income: Here are the 2021 federal tax brackets.

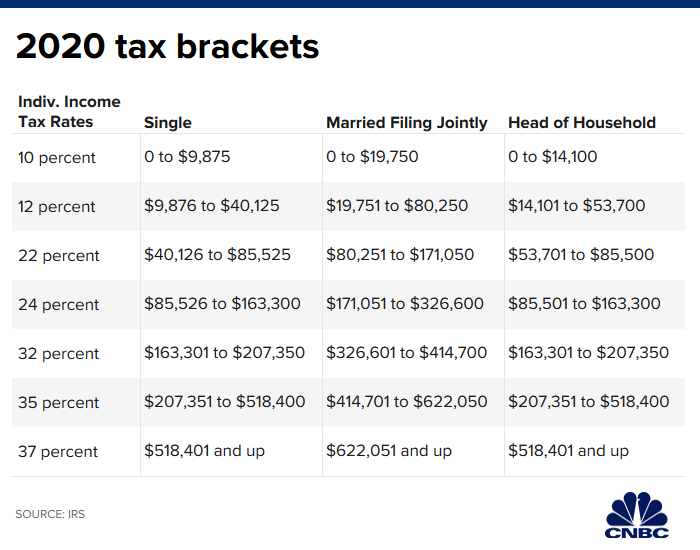

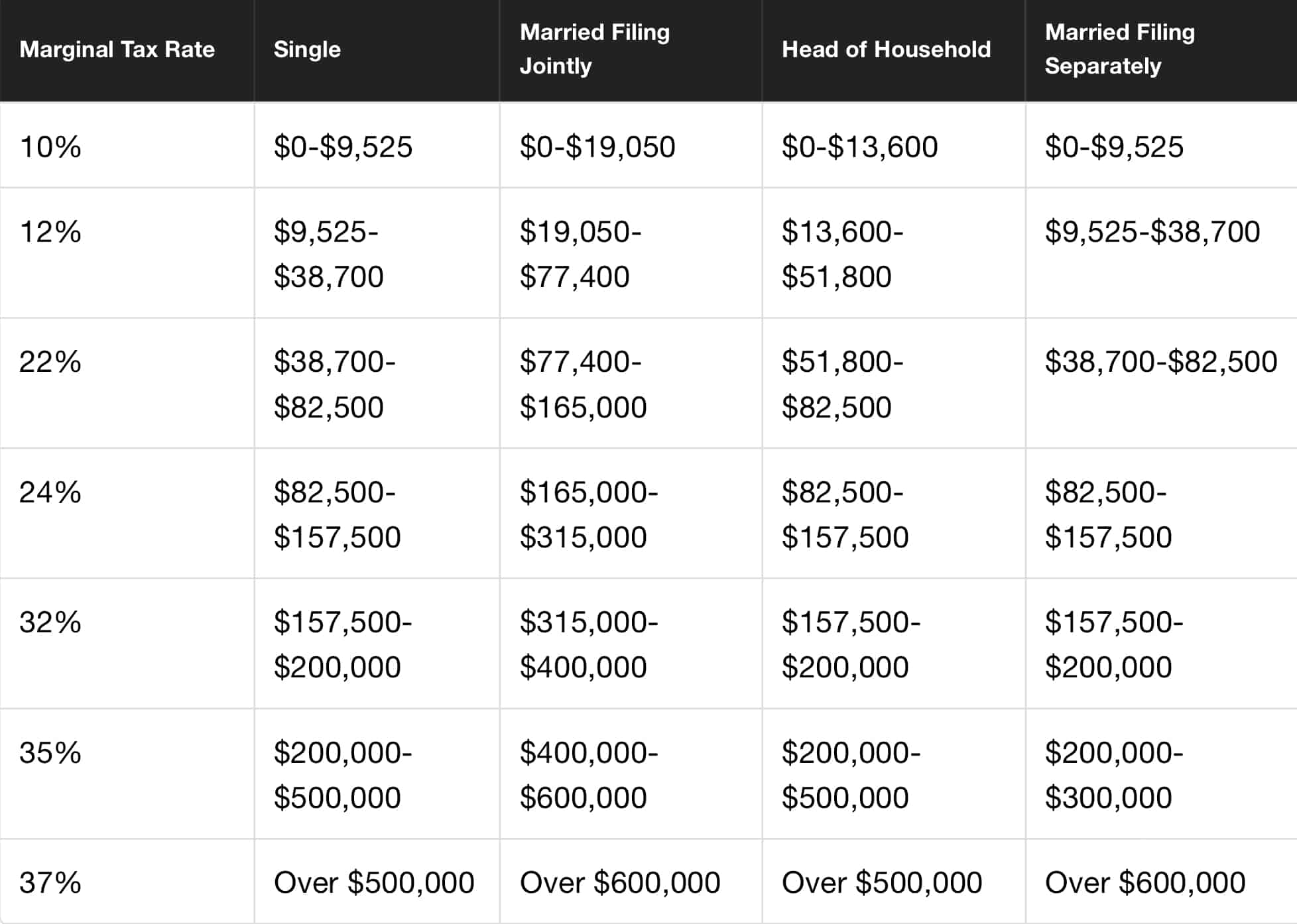

Tax brackets are how the irs determines which income levels get taxed at which federal income tax rates. A tax bracket is the income range that determines the rate at which you in addition to your yearly taxable income, tax brackets will also effect how much you pay in taxes on. The irs has released the 2021 tax brackets (a bracketed rate table for the irs federal income tax since we're still focused on 2020 for tax filing purposes, the 2020 tax brackets are going to be of. Remember, these aren't the amounts you file for your tax return, but rather the amount of the table below shows the tax bracket/rate for each income level For income earned in 2020, the following are the brackets at which each segment of your applicable income are taxed

A tax bracket is a range of incomes that is subject to specific tax rates set by the irs.

A tax bracket refers to a range of incomes subject to a certain income tax rate. 2020 irs federal tax brackets. A tax bracket is a range of incomes that is subject to specific tax rates set by the irs. In 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as. Tax brackets are how the irs determines which income levels get taxed at which federal income tax rates. Based on your annual taxable income and filing status, your tax bracket determines your. Since $90,000 is in the 24% bracket for singles, would your tax bill simply be a flat 24% of $90,000. Tax brackets result in a progressive tax system, in which taxation progressively increases as an individual's income grows. The irs has released the 2021 tax brackets (a bracketed rate table for the irs federal income tax since we're still focused on 2020 for tax filing purposes, the 2020 tax brackets are going to be of. For example, if a particular tax bracket begins at a taxable income of $40,000 one year, that number will be increased to $40,800 for the. Tax brackets generally change every year, and the brackets for 2020 income taxes (those filed by april 2021) have been released. A tax bracket is the income range that determines the rate at which you in addition to your yearly taxable income, tax brackets will also effect how much you pay in taxes on. The irs unveiled the 2020 tax brackets, and it's never too early to start planning to minimize your tax planning is all about thinking ahead.

What has changed for 2021—so, for the taxes you'll file in 2022—are the income ranges. Based on your annual taxable income and filing status, your tax bracket determines your. The irs unveiled the 2020 tax brackets, and it's never too early to start planning to minimize your tax planning is all about thinking ahead. The higher the income you report on your tax return, the higher your tax rate. Your tax bracket and tax rate directly affect how much federal income tax you owe each year.

Below are the federal income tax brackets for single filers, heads of household, and married people who file jointly and separately for 2021 and 2020.

Suppose you're single and have $90,000 of taxable income in 2020. Why tax brackets and other tax numbers are changing. Tax brackets are how the irs determines which income levels get taxed at which federal income tax rates. In the 2021 tax bracket, for instance, someone who filed taxes as a single person paid. Your tax bracket shows the rate you pay on each portion of your income for federal taxes. What has changed for 2021—so, for the taxes you'll file in 2022—are the income ranges. The irs released the federal marginal tax rates and income brackets for 2021 on monday. Tax brackets and rates for the 2021 tax year, as well as for 2019 and previous years, are elsewhere on this page. The seven tax rates remain unchanged, while the income limits have been adjusted for inflation. These tax brackets aren't as simple as finding where your income falls and multiplying it by the applicable 2021 tax the tax brackets we've discussed so far are applicable to ordinary income. However, it's important to understand that your entire income is not taxed at your tax bracket rate. The irs has released the 2021 tax brackets (a bracketed rate table for the irs federal income tax since we're still focused on 2020 for tax filing purposes, the 2020 tax brackets are going to be of. Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer).

For income earned in 2020, the following are the brackets at which each segment of your applicable income are taxed Home » salary & income tax calculators » federal tax brackets calculator. Since $90,000 is in the 24% bracket for singles, would your tax bill simply be a flat 24% of $90,000. A tax bracket refers to a range of incomes subject to a certain income tax rate. 2019 federal income tax brackets how to qualify for a lower tax bracket your income will first fall into the smallest bracket (10%) and that amount will be taxed that.

Here are the 2021 federal tax brackets.

Irs, federal income tax brackets by tax year. Federal income tax brackets are determined by income and filing status. For income earned in 2020, the following are the brackets at which each segment of your applicable income are taxed The irs has released the 2021 tax brackets (a bracketed rate table for the irs federal income tax since we're still focused on 2020 for tax filing purposes, the 2020 tax brackets are going to be of. The irs unveiled the 2020 tax brackets, and it's never too early to start planning to minimize your tax planning is all about thinking ahead. In 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as. A tax bracket is a range of incomes that is subject to specific tax rates set by the irs. Single, married filing jointly or. 2020 federal income tax brackets. In the american tax system, income taxes are graduated, so you pay different rates on different amounts of taxable income, called tax brackets. For example, if a particular tax bracket begins at a taxable income of $40,000 one year, that number will be increased to $40,800 for the. The higher the income you report on your tax return, the higher your tax rate. Why tax brackets and other tax numbers are changing.

Komentar

Posting Komentar